north carolina estate tax exemption 2019

The federal estate tax exemption is 1206 million in 2022 so only estates larger than that amount will owe federal estate taxes. Link is external 2021.

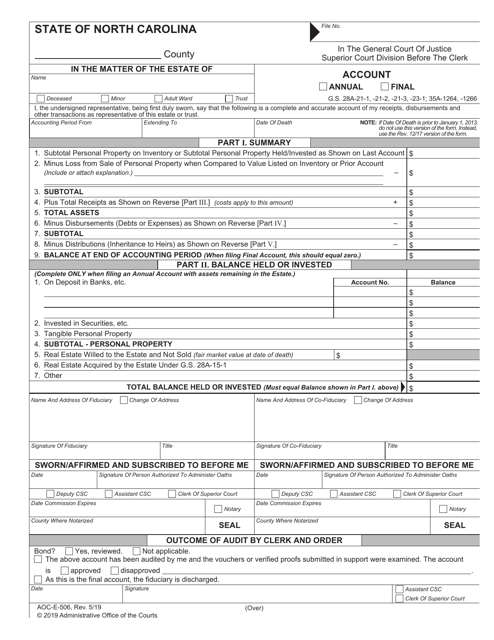

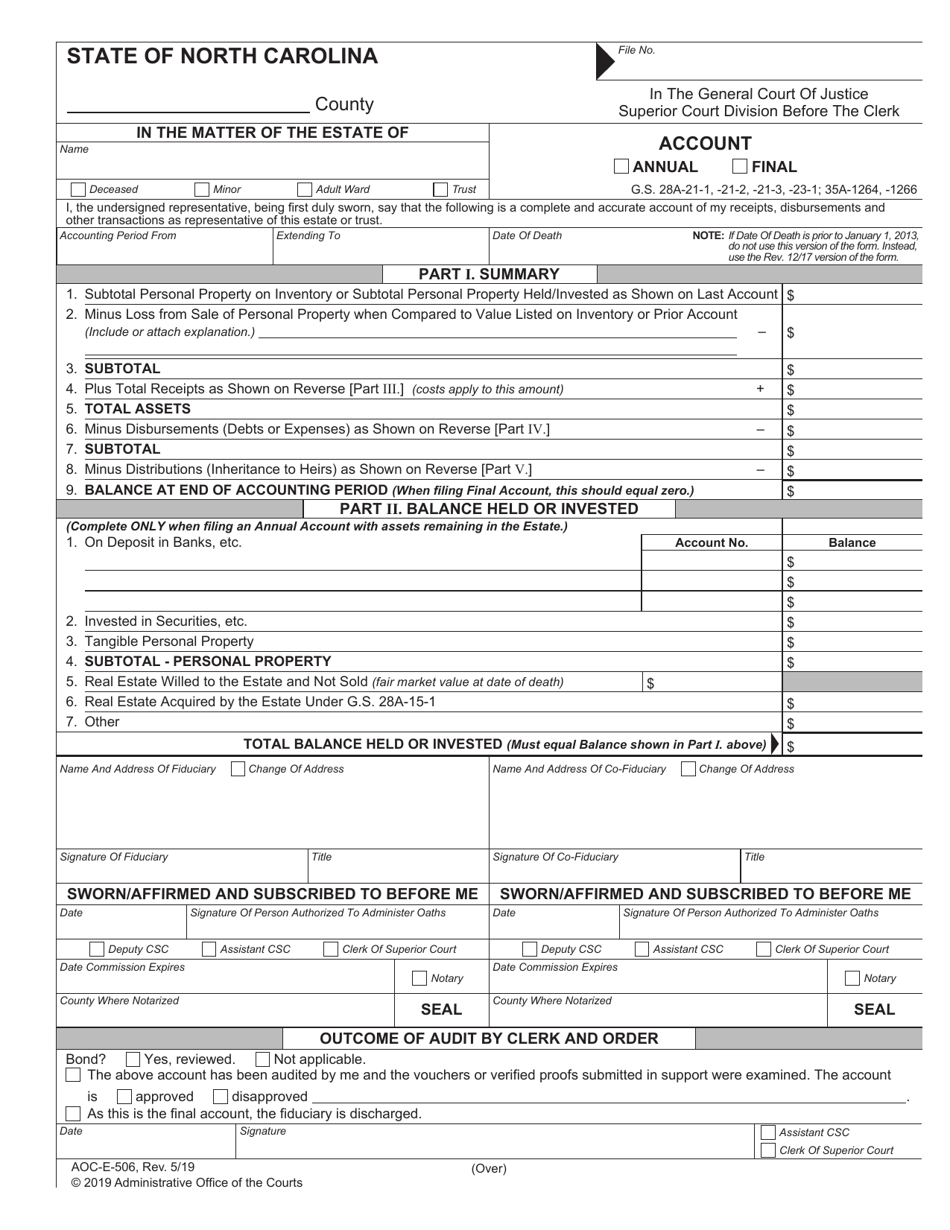

Form Aoc E 506 Download Fillable Pdf Or Fill Online Account North Carolina Templateroller

The income tax withholdings for the State of North Carolina will change as follows.

. See below for a chart of historical Federal estate tax exemption amounts and tax rates Future Changes Expected for the Federal Estate Tax Exemption. Tax implications depend on the type of asset the value and other factors. The federal gift exemption is 15000 per year per recipient for 2021 and increases to 16000 per year per per recipient in 2022.

But dont forget estate tax that is assessed at the state level. When an heir is notified of their inheritance they should carefully review assets in light of their unique tax situation with a North Carolina tax lawyer. An addition is also required for the amount of state local or foreign income tax deducted on the federal return.

Yes a form is required for Purchase Card Transactions. Just about anyone with a life insurance policy in place would have been subjected to the estate tax 20 years ago. North carolina department of revenue.

Senate Bill 346. No estate tax or inheritance tax. Top North Carolina Public Policy Issues Affecting Nonprofits.

Nonprofit tax-exemption isnt merely a handout or an anachronism but rather is part of an important social compact. While North Carolinas estate tax was repealed in 2013 other taxes may apply to an inheritance. The State withholding tax rate will decrease from 5599 percent to 535 percent.

The standard deduction for Head of Household filers will increase. Worker Misclassification and Nonprofits. 1 An occupational licensing.

105-16429A - State government exemption. Current Federal Estate Tax Exemption. Threats to Nonprofit Tax Exemption in 2019.

Importantly if the taxpayer deducts the maximum 10000 for real estate taxes paid or accrued during the taxable year on the State return the taxpayer can also deduct up to 10000 for mortgage expenses paid or accrued if the mortgage expense meets. While there isnt an estate tax in North Carolina the federal estate tax may still apply. David Heinen Vice President for Public Policy and Advocacy North Carolina Center for Nonprofits.

Owner or Beneficiarys Share of NC. 2019 North Carolina General Statutes Chapter 105 - Taxation Article 5 - Sales and Use Tax. Who do I contact if I have questions.

For information on exemption certificate procedures and exemption number requirements in North Carolina see Sales and Use Tax Bulletins which can be found on the Departments website at wwwncdorgov or you may contact the Taxpayer Assistance and Collection Center at 1-877-252-3052 toll free. This amount can vary from year to year. This section does not apply to any of the following State agencies.

The exercise of the powers granted by this Chapter will be in all respects for the benefit of the people of the State and will promote their health and welfare. Most 501 c 3 nonprofits in North Carolina are exempt from most state and local taxes. No estate tax or inheritance tax.

Individual income tax refund inquiries. As of 2021 the exemption sits at 2193 million and the top tax rate is 20. The federal taxable income of the fiduciary is the starting point for preparing a North Carolina Income Tax Return for Estates and Trusts Form D-407 and requires the same additions and deductions.

Thankfully less than 1 of Americans will have an estate tax issue. As of 2019 if a person who dies. 105-16413 105-16414 105-16429C 105-236 105-467 Sections CLINICS COLLEGES UNIVERSITIES COMMERCE CORPORATIONS NONPROFIT EDUCATION EMERGENCY MEDICAL SERVICES EMERGENCY SERVICES FIREFIGHTERS FIREFIGHTING HEALTH SERVICES HIGHER.

5520 sharon view rd charlotte north carolina 28226. No estate tax or. Property Left to the Surviving Spouse Before the repeal property left to the surviving spouse was exempt from state estate tax as it is currently exempt from federal estate tax--no matter what the amount.

Finally certain family-owned businesses received an estate tax exemption of up to 25 million. Do I need a form. Threats to Tax Exemption and Incentives for Charitable Giving.

The annual gift and estate tax exemption is the dollar amount worth of gifts that you can give away in your lifetime before you have to pay an actual gift tax. In 1997 the estate tax exemption was 600000 and the top estate tax rate was 55. NC K-1 Supplemental Schedule.

North Carolina Department of Revenue 877 252-3052 Updated 02022022. Homeowners age 65 or older whose spouse is deceased can exempt up to 60000 under the homestead exemption if the property was previously owned by the debtor as a tenant by the. This bill will annually increase the states estate tax exemption until it matches the federal estate tax exemption of 117 million in 2023.

Application for Extension for Filing Estate or Trust Tax Return. Form E-595E Streamlined Sales and Use Tax Agreement Certificate of Exemption. Are Travel IBA 6th digit 1 2 3 4 transactions sales tax exempt.

The current Federal Estate Tax Exemption for 2021 is 117 million per individual. In the Tax Cuts and Jobs Act the federal government raised the estate tax exclusion from 549 million to 112 million per person though this provision expires December 31 2025. Then the estate tax rates for the top four brackets increased by one percentage point.

This increases to 3 million in 2020 Mississippi. Delaware repealed its estate tax in 2018. First the states 2 million exemption was indexed for inflation on an annual basis.

There is no gift tax in North Carolina. The top estate tax rate is 16 percent exemption threshold. Possible state tax issues for nonprofits.

Beneficiarys Share of North Carolina Income Adjustments and Credits. The Secretary must assign a sales tax exemption number to a State agency that submits a proper application. 2019 North Carolina General Statutes Chapter 131A - Health Care Facilities Finance Act 131A-21.

The tax rate on funds in excess of the exemption amount is 40. Under the North Carolina exemption system homeowners can exempt up to 35000 of their home or other real or personal property covered by the homestead exemption. For 2022 the federal estate tax exemption is 12060000 and the top federal estate tax rate is 40.

Nonprofit Sales Tax Exemption. But for individuals the Tax Cuts and Jobs Act raised that to 117 million for 2021 and 1206 million for 2022. Estate and inheritance taxes are burdensome.

An individual who files a North Carolina return as married filing separately may not deduct more than 5000 of real estate taxes. The standard deduction for Single Married and Qualifying Widow er filers will increase from 8750 to 10000. Income taxes are bad enough but then you have to consider estate taxes.

Five short years later in 2002 the exemption had.

Tax Administration Duplin County Nc Duplin County Nc

North Carolina State Taxes 2022 Tax Season Forbes Advisor

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

North Carolina Tax Reform North Carolina Tax Competitiveness

Florida Quit Claim Deed Form Quitclaim Deed Wisconsin Gifts Transfer

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

Tax Administration Duplin County Nc Duplin County Nc

Highlights Of North Carolina S Tax Changes

135 Stillwater Rd Troutman Nc 28166 Realtor Com

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

Form Aoc E 506 Download Fillable Pdf Or Fill Online Account North Carolina Templateroller

Asset Protection In North Carolina What Can You Do To Protect Your Assets From Your Creditors Creditors Estate Planning Asset

North Carolina Special Proceedings To Sell Real Property Hopler Wilms Hanna

North Carolina Gift Tax All You Need To Know

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

North Carolina Tax Reform North Carolina Tax Competitiveness

North Carolina Tax Reform North Carolina Tax Competitiveness

Frequently Asked Questions Carolina Tax Trusts Estates

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation