haven't filed taxes in 10 years canada

Whether your late tax filing is 1 year 5 years or even 10 years past due it is important to act and get compliant immediately. You will owe more than the taxes you didnt pay on time.

Grand Prince Hotel Mirpur 1216 Dhaka World Hotel Reviews Hotel Reviews Hotel Outdoor Swimming Pool

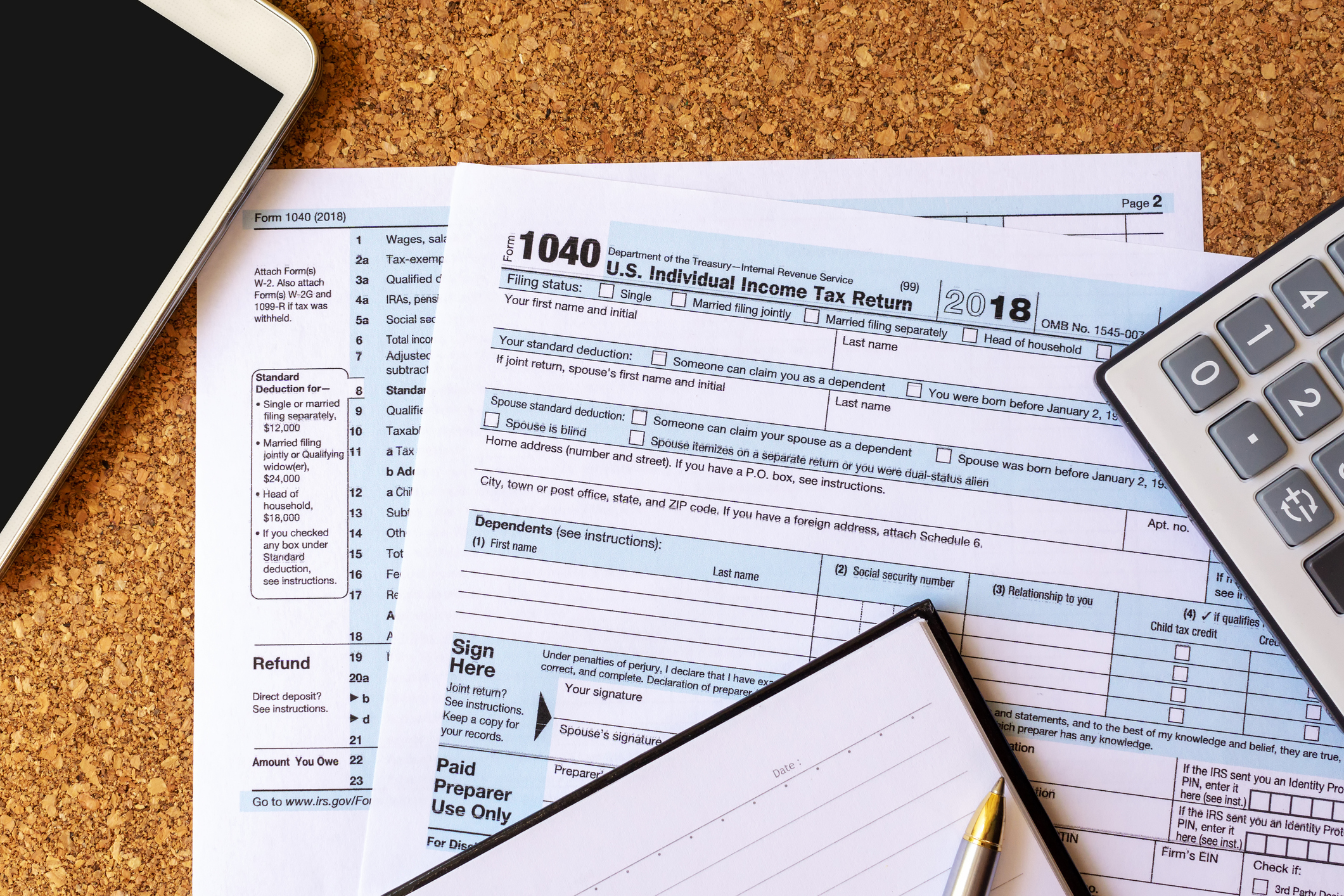

According to the CRA a taxpayer has 10 years from the end of a calendar year to file an income tax return.

. How Many Years Can You Go Without Filing Taxes In Canada. -1 level 2 4 yr. Ad Use our tax forgiveness calculator to estimate potential relief available.

Ad Owe taxes and cant pay. Buy That House Extend That Credit You need For Your Business Once This Goes Away For Good. I heard after ten years you cant actually file that years taxes.

Avoid the hefty tax penalties. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. According to Section 238 of the Income Tax Act failing to file your tax return can result in a fine of 1000 25000 and up to one year in prison.

Ad Some Tax Returns May Not Need To Be Filed. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for. What happens if you havent filed taxes in 10 years in Canada.

If you havent filed in years and the CRA has not yet contacted you about your late taxes apply to the Voluntary. Let Us Work With You To Solve This Problem Fast. There is no requirement to file income taxes in Canada unless you owe money or are asked to file by Canada Revenue Agency.

Bench Retro gets your books in order so you can file fast. If you go to genutax httpsgenutaxca you can file previous years tax returns. Get a Fast and Free Consultation and End Your IRS Tax Problems.

We Can Help Suspend Collections Liens Levies Wage Garnishments. Theres that failure to file and failure to pay penalty. Filing taxes late in.

The longer you go without filing. Ad Our expert bookkeepers will help maximize your deductionsand limit your tax liability. Bench Retro gets your books in order so you can file fast.

A taxpayer has 10 years from the end of the year in which they. What was the time it took y to file taxes in Canada. If they do not have them on hand for you they will arrange to have them mailed to.

However not filing taxes for 10 years or more exposes you to steep. In all cases regardless of whether you owe money or not you should file your return as soon as possible if you have not filed your tax return for this year or for previous. Go to a local Canada Revenue Agency office and pick up tax forms for the years you are missing.

Have you been contacted by or acted upon Canada. Restaurants In Matthews Nc That Deliver. Ad Get Back Taxes Help in 3 Steps.

Section 239 of the Income Tax. Ad Created By Former Tax Firm Owners Based on Factors They Know are Important. Not sure what you mean but this.

You will also be required to pay penalties for non-compliance. See the Top Rankings for Tax Help Companies That Fix IRS and State Tax Problems. If you fail to file on time again within a three-year period that penalty goes up to 10 of unpaid taxes plus 2 per month for a maximum of 20 months.

This is because the CRA charges penalties for filing and paying taxes late. The failure to file penalty also known as the delinquency penalty runs at a severe rate of 5 up to a maximum rate of 25 per month or partial. Avoid the hefty tax penalties.

How far back can you go to file taxes in Canada. Opry Mills Breakfast Restaurants. As soon as you miss the tax deadline typically April 30 th each year for most people there is an automatic late.

According to the CRA a taxpayer has 10 years. Ad Get Back Taxes Help in 3 Steps. You owe fees on the.

Qualify for a Tax Relief with the IRS Fresh Start program. We Can Help Suspend Collections Liens Levies Wage Garnishments. If you havent filed in years and the CRA has not yet contacted you about your late taxes apply to the Voluntary Disclosure Program as soon as possible.

Havent filed taxes in 10 years canada. This helps you avoid. Havent filed personal or small business T1 corporate income tax T2 or GSTHST returns in several years or more.

Havent Filed Taxes In 10 Years Canada Reddit. However not filing taxes for 10. Further the CRA does not go back greater than 7 years.

Ad Our expert bookkeepers will help maximize your deductionsand limit your tax liability. If you earned this money while out of the country for greater than 2 years you are not required to file a return on it. Whatever the reason once you havent filed for several years it can be tempting to continue letting it go.

Top Reasons Your Tax Refund Could Be Delayed Turbotax Tax Tips Videos

What Is Irs Form 1099 Div Dividends And Distributions Turbotax Tax Tips Videos

Can Credit Card Companies Garnish My Wages Bankrate

Will Student Loans Take My 2021 Tax Refund Nerdwallet

Millions Of Americans Won T See Their Tax Refunds For Months Time

Buy Elefun Friends Hungry Hungry Hippos Game From The Next Uk Online Shop Spiele Kinderspiele Lustige Spiele

My Refund Illinois State Comptroller

Tax Form 1099 R Jackson Hewitt

How To Do Your Back Income Taxes Turbotax Tax Tips Videos

As An F1 Student How Do I Report Cryptocurrency On My Taxes

Can I Deduct Legal Fees On My Taxes Turbotax Tax Tips Videos

What To Do If You Ve Never Filed A Tax Return

What Was Your Adjusted Gross Income For 2019 Federal Student Aid

Anthony Bourdain Owed 10 Years Of Taxes

Tax Day Is Coming Soon Here S What You Need To Know About Filing Your 2021 Taxes Chicago News Wttw

How To Show Proof Of Income A Guide For The Self Employed

Grand Prince Hotel Mirpur 1216 Dhaka World Hotel Reviews Hotel Reviews Hotel Outdoor Swimming Pool

/TaxCredit-cd8d4101b88f4d94afcf390b63f1738b.jpg)